The Self-Employed module is designed for tax professionals in the US who want a streamlined way to file business returns for maximizing business deductions. It allows them to get the best from smoother invoice submissions, including tailoring the account to match tax deduction categories for C-Corps and S-Corps.

Tax professionals in the US will need to ensure their relevant tax returns are submitted to the Internal Revenue Service (IRS) to report any income or loss from their businesses, or their clients’ businesses.

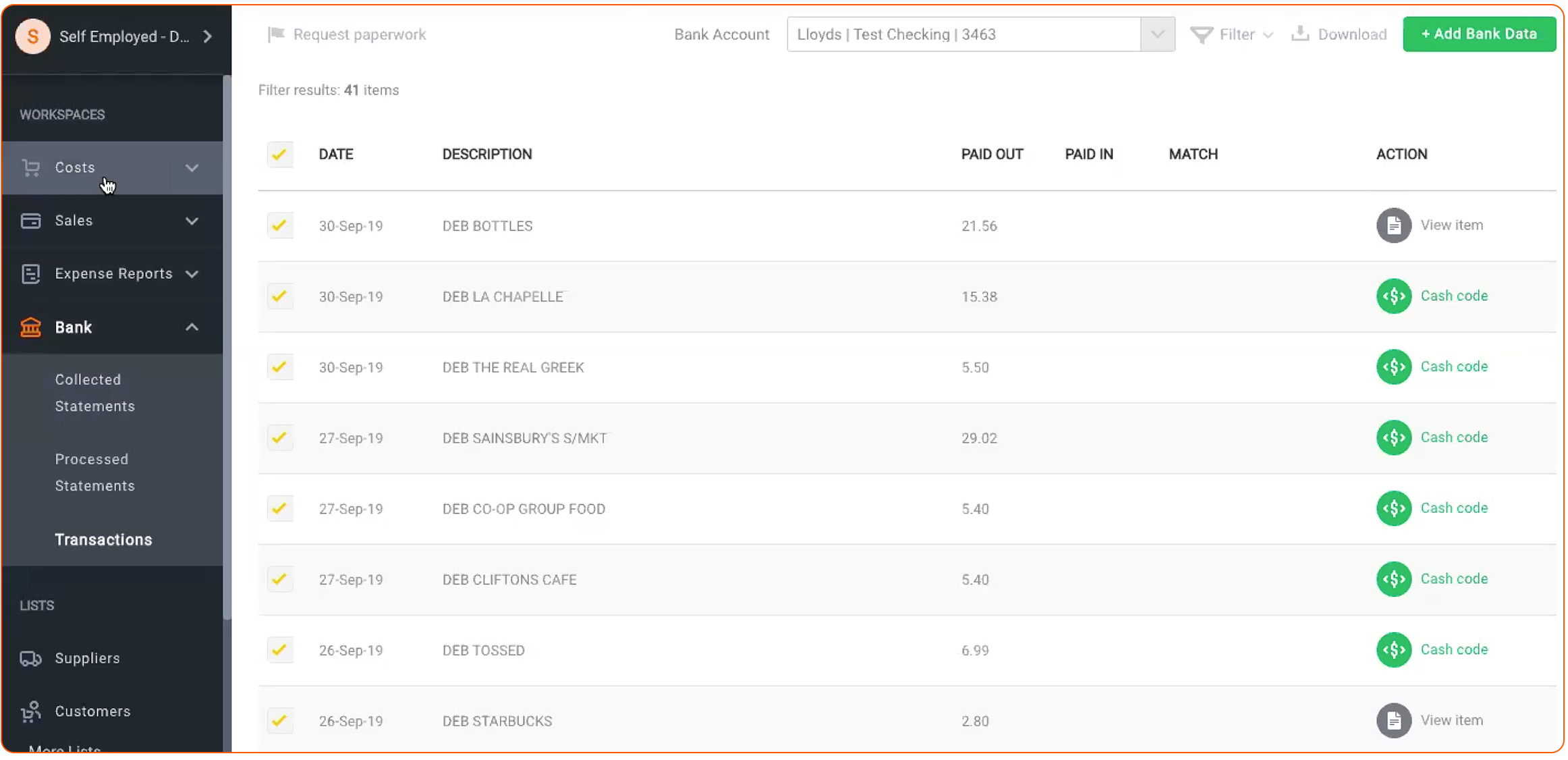

Dext Prepare’s Self-Employed module ensures that whenever you submit documents, the settings for Tax codes that pertain to C and S-Corps are applied to ensure your invoice, bank statement, and receipt submissions, and tax summary creation, is more intuitive for smoother tax business returns.

For understanding how to use the Self-Employed module, please refer to our guide on how to use Dext Prepare Self-Employed.

For further information on what the Schedule C form is, please refer to this article from the IRS.