Canadian businesses pay two different tax rates: PST and GST/HST. Use the tax rate field on the item detail page to publish both rates across to QuickBooks Online.

Please note that this is a different process to processing secondary tax rates on Cost items.

Dext Prepare will extract the first line of tax applied to a submitted Sales Invoice. If the item has multiple tax rates:

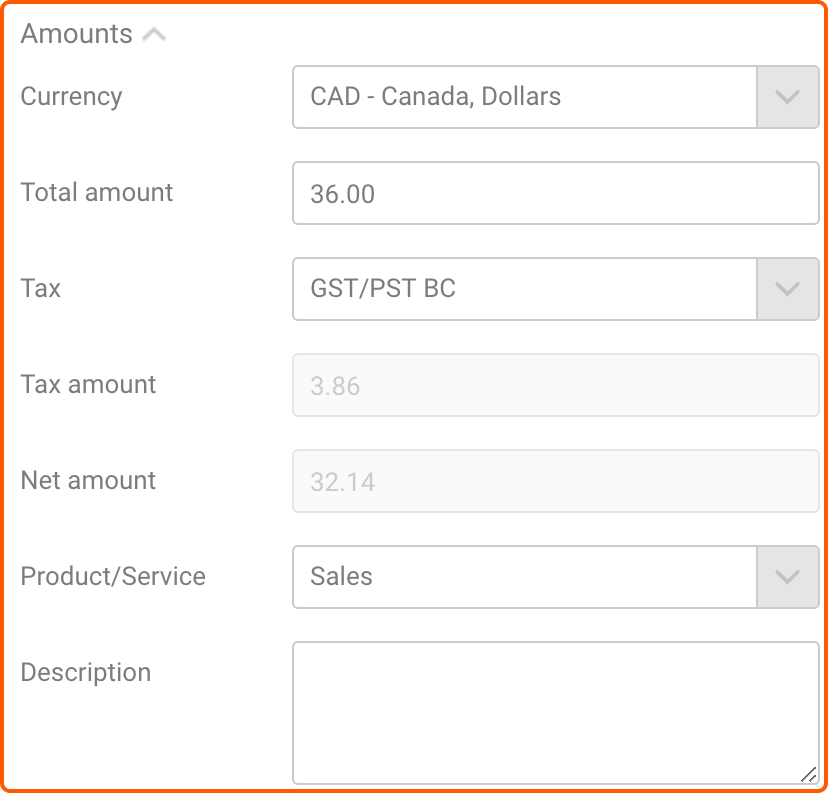

- If the item has a single multiple-rate tax, such as GST/PST, select the relevant tax rate from the Tax Rate dropdown. This will calculate the tax based on the item total.

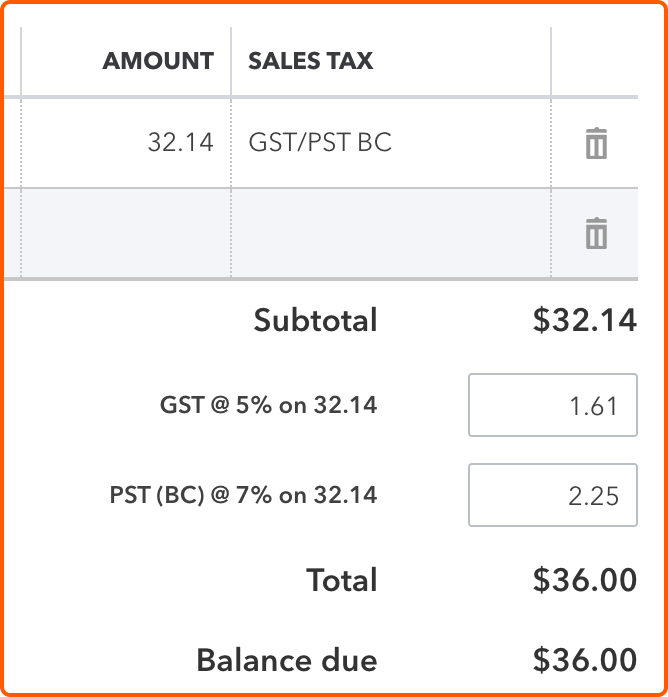

When the item is published to QuickBooks Online, both taxes will be split automatically according to the split tax rate:

- If the item has multiple tax rates, such as GST/PST and GST Free, create Line Items to split the different taxes across multiple lines in QuickBooks Online.

- Enter the invoice tax amount in the Tax Amount column and publish the item to QuickBooks Online. In QuickBooks Online, assign the primary and secondary tax rates to the extracted amount.